Whether you’re a lifelong resident of New Jersey or a newcomer to New York, the most populous city in the United States, it’s important to understand that the housing market here is influenced by both nationwide trends and unique local characteristics. New Jersey’s neighborhoods range dramatically from the densely populated urban core to quiet residential streets, from shopping districts to hubs largely populated by college students.

Here are five important things to know about the housing market before looking for funding in New Jersey:

- Steady Price Increase

- Intense Buyer Competition Outside Downtown Areas

- Emphasis on Square Footage and Outdoor Spaces

- Suburban Living with Small Downtowns

- Attractiveness to Real Estate Investors from Costlier Metros

Steady Price Increase

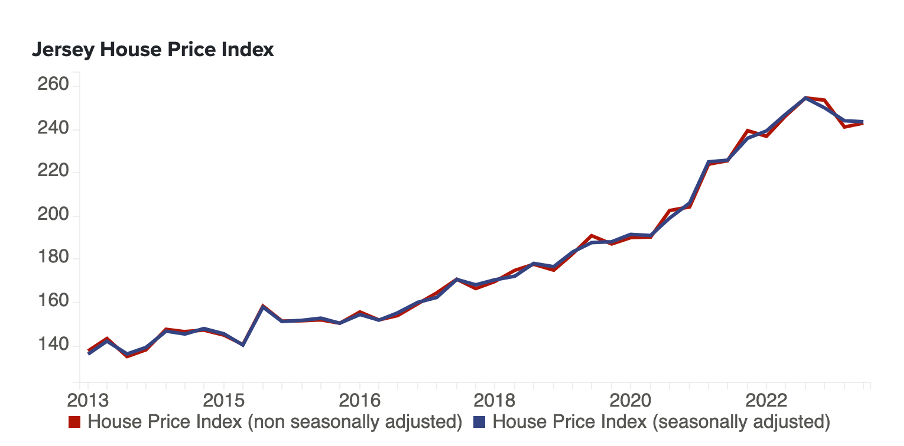

Like much of the rest of the country, New Jersey is seeing rapid and positive price growth for homes, but at a slower climb than smaller metro areas. Average prices for most property types are largely unaffected by these new developments. However, the mean price for a 2-bedroom apartment would have been considerably lower. This is because the new developments were largely sold off plan before increases in the Bank of England base rate had impacted the market. Without the transactions within these new developments, the overall House Price Index would have decreased by 4% compared with Q2 2022, rather than the decrease of 1% recorded.

These sales from new developments make up a significant proportion of turnover, which means that they have a large impact on the composition of market sales statistics, particularly for flats.

In the second quarter of 2023:

- On a quarterly basis:

- the seasonally adjusted mix-adjusted average price was essentially unchanged compared with the previous quarter

- there was a 1% annual decrease in the House Price Index, the first decrease seen since Q3 2016

- the seasonally adjusted mix-adjusted average price was 4% lower than the previous high point seen in Q3 2022

- all types of house saw their mean price decrease compared with Q2 2022, while other property types saw an increase in their mean price compared with Q2 2022

- the turnover of properties was 42% lower than in Q2 2022, and we observed in this quarter:

- 28% of properties transacted were not purchased to be the main residence of the purchaser(s), an 8 percentage point decrease from the previous quarter

- overall housing market activity, on a rolling four-quarter basis, was 13% lower compared with the previous quarter (Q1 2023) and 23% lower than in the corresponding quarter of 2022 (Q2 2022)

- on a rolling four-quarter basis, advertised private sector rental prices were 7% higher during the year ending Q2 2023 compared with the year ending Q2 2022

Intense Buyer Competition Outside Downtown Areas

Part of what’s keeping the New York metro area’s numbers more conservative than other parts of the state is its densely populated downtown area, which has been markedly quieter in terms of homebuyer and renter activity during and after the COVID-19 pandemic. Buyers looking in neighborhoods where houses, townhouses and small condo buildings are common should prepare to have to compete with other bids.

Emphasis on Square Footage and Outdoor Spaces

One trend for New Jersey area homebuyers in 2023 that’s also reflected nationwide is the desire for space – more rooms for a home office or virtual classroom and outdoor space that makes it easy to enjoy the outdoors privately.

Suburban Living with Small Downtowns

If you want to live farther from downtown and even outside the city of New York, you can find the most popular spots by looking for a small downtown that makes the suburb more self-sustaining. Especially as people are expecting to travel into the office less often in the future, a suburban downtown can offer the community amenities a person wants without the added density and traffic of the city.

Attractiveness to Investors from Costlier Metros

“Growing interest from out-of-town investors has become apparent as recently as February. They haven’t necessarily invested in real estate before, but see the advantage and otherwise can’t afford to invest where they live, like New York, Los Angeles or San Francisco” – says Sami Solomon, the CEO of Real Estate Funding Solutions.

New Jersey offers a more budget-friendly alternative for real estate funding, despite its proximity to New York, which offers a great deal of job opportunities and entertainment options.

For real estate investors considering New Jersey for funding, colonial and ranch-style houses are readily available within the city. Investing in one of these properties allows you to both live in one unit and generate rental income from the others. Of course, this comes with the added responsibility of managing rental properties. However, it presents a practical entry point for those exploring real estate investments in the area.